Get the free form 10f fillable

Show details

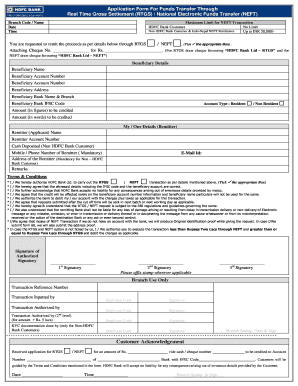

FORM NO. 10F See sub-rule 1 of rule 21AB Information to be provided under sub-section 5 of section 90 or sub-section 5 of section 90A of the Income-tax Act 1961 I son/daughter of Shri. in the capacity of designation do provide the following information relevant to the previous year in my case/in the case Nature of information i Status individual company firm etc* of the assessee ii Permanent Account Number PAN of the assessee if allotted iii Nationality in the case of an individual or Country...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form 10f form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 10f form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 10f fillable online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 10f. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

How to fill out form 10f

How to fill out form 10f:

01

Start by gathering all the necessary information and documents required to complete form 10f.

02

Carefully read the instructions provided with the form to understand the specific requirements and guidelines.

03

Begin by entering your personal details, such as your full name, address, date of birth, and contact information, in the designated sections.

04

Provide relevant information about your employment, including your employer's details and your job title.

05

Fill in the details of your income and tax payments for the relevant period, ensuring accuracy and completeness.

06

If applicable, include any deductions, exemptions, or credits you are eligible for.

07

Double-check all the information entered to ensure accuracy and completeness.

08

Sign and date the form in the designated section.

09

Make a copy of the completed form for your records.

10

Submit the filled-out form 10f to the appropriate authority or entity as instructed.

Who needs form 10f:

01

Individuals who have earned income from a foreign country during the assessment year.

02

Non-resident Indians (NRIs) who have earned income in India and are eligible for tax exemption under the relevant tax treaty.

03

Individuals who want to claim relief or avoid double taxation on their foreign income.

04

Taxpayers who need to report and disclose any foreign assets or investments as required by tax laws.

Note: It is advisable to consult with a tax professional or seek guidance from the relevant tax authority to ensure accuracy and compliance while filling out form 10f.

Video instructions and help with filling out and completing form 10f fillable

Instructions and Help about form 10f online filing

Fill 10f form pdf : Try Risk Free

What is 10f income tax form?

India has signed Double Taxation Avoidance Agreements (DTAAs) with many countries so that the income is taxed only once. ... One has to file Form 10F, a tax residency certificate and self declaration in the prescribed format to the entity responsible for deducting tax at source.

People Also Ask about form 10f fillable

What is form 10F for?

Is form 10F to be filed online?

What is Rule 37BC of income tax?

What is tax residency certificate India?

Who needs form 10F?

Who verifies Form 10F?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out form 10f?

Form 10F is a form used by Indian citizens who wish to open a Non-Resident Ordinary (NRO) bank account in India.

To fill out Form 10F, you will need to provide the following information:

• Your full name

• Your date of birth

• Your address

• Your phone number

• Your email address

• Your passport number

• Your PAN (Permanent Account Number)

• Your purpose for opening the account

• Your signature

Once you have completed the form, you will need to submit it to the bank where you wish to open the account. The bank will then review your application and, if approved, open your NRO bank account.

What is the penalty for the late filing of form 10f?

There is no penalty for the late filing of a Form 10F. However, you may be charged interest and penalties for any taxes due as a result of the filing.

Who is required to file form 10f?

Form 10F is not a specific form that is required to be filed by any individual or entity. However, there is a Form 10-K that certain publicly traded companies in the United States are required to file annually with the Securities and Exchange Commission (SEC). This form provides a comprehensive summary of a company's financial performance and other relevant information.

What is the purpose of form 10f?

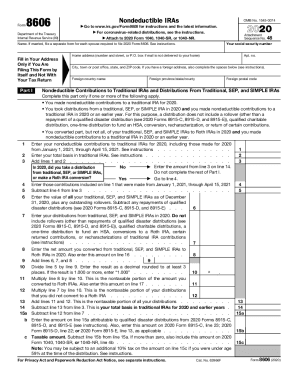

Form 10F is typically used to apply for a certificate of no deduction or lower deduction of tax. Its purpose is to certify that the individual or entity claiming the benefit of a tax treaty between their country of residence and India is eligible for a reduced rate of tax or exemption from tax on certain types of income derived in India. The form is mainly utilized to avoid or reduce the rate of deduction of tax at source on various types of income, such as interest, dividends, royalties, etc., as per the provisions of the relevant tax treaty.

What information must be reported on form 10f?

Form 10F, also known as the Foreign Asset Reporting Form, is required to be filed by Indian residents who possess foreign assets or have a financial interest in any foreign entity. The following information must be reported on Form 10F:

1. Personal Information: Name, address, PAN (Permanent Account Number), and passport details of the individual filing the form.

2. Status: The residential status of the individual (Resident, Non-Resident, or Resident but Not Ordinarily Resident) for the relevant financial year.

3. Foreign Assets: Detailed information about the foreign assets held, such as bank accounts, immovable property, financial interest in any entity, etc. The value of each asset must be reported in the relevant currency.

4. Income from Foreign Sources: Any income earned from foreign assets, including interest, dividends, rent, etc., should be reported under this section.

5. Tax Relief: Information regarding any tax relief or double taxation relief claimed under the provisions of the Double Taxation Avoidance Agreement or tax treaties.

6. Bank Account Details: Details of foreign bank accounts, including the name and address of the bank, account number, and account balance as at the end of the financial year.

7. General Information: Any other relevant information or disclosures related to foreign assets that may be required to be reported.

It's important to note that the specific reporting requirements may vary based on the individual's residential status and the nature of their foreign assets. It is advisable to consult with a tax professional or refer to the official guidelines provided by the Income Tax Department of India to ensure accurate and complete reporting.

How can I send form 10f fillable for eSignature?

Once your form 10f is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an electronic signature for the 10f form online in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your form no 10f in seconds.

How do I complete form 10f india on an Android device?

On Android, use the pdfFiller mobile app to finish your in form 10 f. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your form 10f online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

10f Form Online is not the form you're looking for?Search for another form here.

Keywords relevant to form 10f word format

Related to india form 10f

If you believe that this page should be taken down, please follow our DMCA take down process

here

.